Nigeria made a barn-storming return to the US dollar bond market when it defied expectations and shaky fundamentals to print below 8% yield on a book that almost hit US$8bn.

25 April 2024

Nigeria made a barn-storming return to the US dollar bond market when it defied expectations and shaky fundamentals to print below 8% yield on a book that almost hit US$8bn.

EMEA Finance interview the renowned economist; Jeffrey Sachs.

DONG Energy pushes forward with plans to add a further 5GW of offshore wind capacity to its portfolio by 2025 with major project awards in Germany.

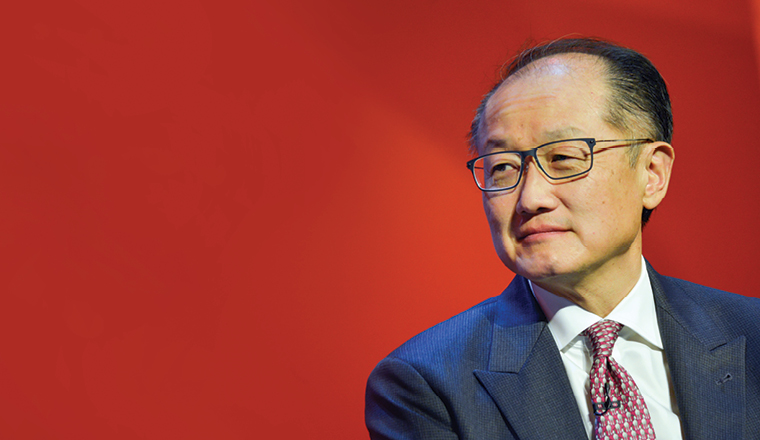

World Bank president Jim Yong Kim sets out a radical agenda for his second term that will move it away from direct funding towards de-risking projects in Africa to make them more attractive to private capital.

Russia’s PIK Group has plans to ramp up capital markets activity in the coming years, as the firm announces a consolidation of its shareholder structure with company president Sergei Gordeev buying out two minority holders.

Ambitious issuance marks a first for EMEA region, but not without taking a few bumps and bruises along the way.

The International Bank of Azerbaijan has laid out comprehensive restructuring plans for US$3.3bn of debt that includes a 20% haircut to principal on senior bonds, sparking an outcry among investors.

The Gulf was plunged into crisis in early June after Qatar came under a wave of sanctions led by Saudi Arabia that has already led to heavy selling in Qatari assets, and market analysts are trying to decipher if this will be a long and drawn out event.

A global race is on between stock exchanges to host Saudi Aramco’s US$100bn initial public offering

Investors appear willing to back Egypt’s long-term growth, after the IMF delivered a US$12bn endorsement