Our pick of the best banks supporting corporate clients' treasury departments.

25 April 2024

Our pick of the best banks supporting corporate clients' treasury departments.

Qatar hasn’t witnessed a new bond issuance this year. This could soon change, writes Mark Dunne.

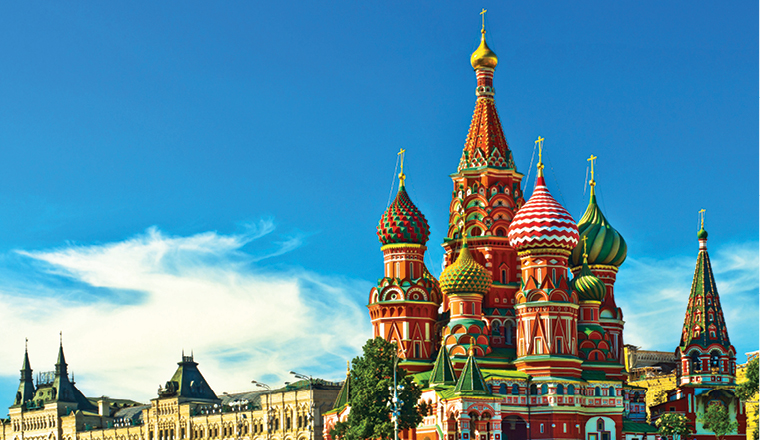

Russia’s listed leaders dominate our CEE & CIS rankings – companies in other regions will need to work hard to catch up.

Companies are rethinking their global transaction banking strategies to save money and time. Liz Salecka reports.

Centralising cash management systems can save global companies time and money. But doing it isn’t easy. Liz Salecka reports.

An initiative to upgrade and integrate West Africa’s intra-bank payment systems is gathering pace, with the Central Bank of Nigeria inviting tenders for a new real time gross settlement (RTGS) system to replace its existing set-up.

The movement to bring together cash management and trade finance capabilities is gaining momentum. For banks it’s a means of improving client relationships. For corporates, it holds the promise of greater control over working capital. emeafinance brought together heads of trade finance and transaction banking from leading institutions to discuss how the cash and trade concept is being applied.

Cross-border investment activity is fuelling the need for securities services across the EMEA region to meet challenges posed by varied regulation and tax regimes as well as weaker market infrastructure. By Liz Salecka.

The financial crisis has led many corporates to prioritise internal liquidity management in the face of more expensive and less readily available bank credit, writes Liz Salecka.

The proliferation of legacy systems at CEE banks has proved a major challenge for many western banks that have made acquisitions in the region. But there are a number of different strategies that they can pursue to ensure IT savings, the exploitation of synergies, and a more efficient IT infrastructure, writes Liz Salecka.

Nigerian arm of pan-African bank secures US$150mn from seven lenders.

Polish insurance group plans to sell subordinated debt by the end of the year.