Despite the collapse of the ruling coalition, investors are hopeful the Hungarian government can stick to its fiscal austerity plans and weather the global credit crunch, writes Kester Eddy in Budapest.

20 April 2024

Despite the collapse of the ruling coalition, investors are hopeful the Hungarian government can stick to its fiscal austerity plans and weather the global credit crunch, writes Kester Eddy in Budapest.

Mozambique is creeping back onto investors’ radar scanners, as commercial financing trickles grow steadier, writes Kevin Godier.

For decades Libya was a ‘pariah’ state, shunned by the international community. In 2004 the doors were flung open and foreign investors were enticed in, promises were made, contracts signed, hopes raised. Four years on however it appears that inertia and backtracking by the Gaddafi administration has set in. Was it all too good to be true after all, asks Nicholas Noe.

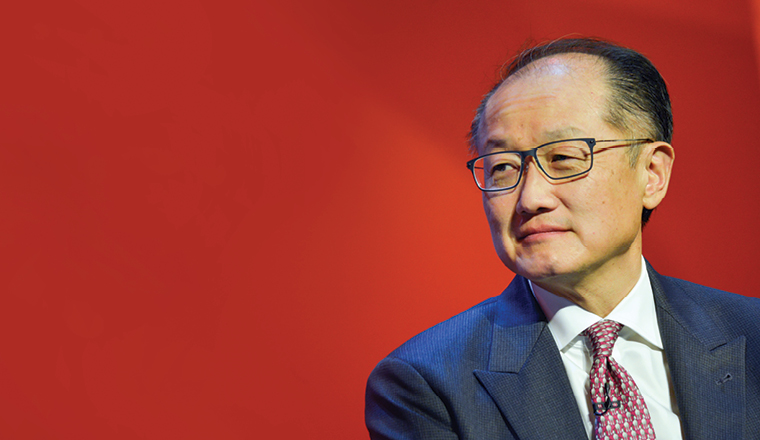

World Bank president Jim Yong Kim sets out a radical agenda for his second term that will move it away from direct funding towards de-risking projects in Africa to make them more attractive to private capital.

DONG Energy pushes forward with plans to add a further 5GW of offshore wind capacity to its portfolio by 2025 with major project awards in Germany.

Nigeria made a barn-storming return to the US dollar bond market when it defied expectations and shaky fundamentals to print below 8% yield on a book that almost hit US$8bn.

Bank of Sharjah is marketing a new US dollar bond, and the issuer will likely have to field tricky questions on one of its major shareholders after Standard & Poor’s slashed the Emirate of Sharjah’s rating by two notches at the end of January.

Qatar came bursting back onto the bond market at the end of May with a US$9bn triple tranche trade, with a deal that looks set to kick-start more issuance from the country.

Republic's 12-year euro issuance this week attracted orders of €1.7bn.

Oman’s Bank Dhofar plans to boost its tier 1 capital in the coming months as well as launch its first international bonds.

Country is likely to see economy pulled into recession by Russia’s problems.