Published: November 19, 2021

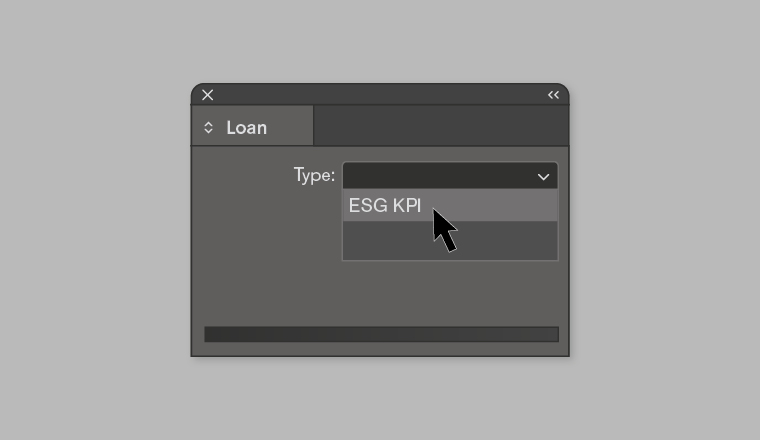

This year, the CEEMEA syndicated loans market remains slower than usual, with levels of activity comparable to 2020, and ESG KPIs nearly a prerequisite.

The Covid-19 pandemic has wreaked havoc on financial systems throughout the world. Even as the economy rebounds, syndicated lending across the CEEMEA region remains sluggish, with overall volumes much the same as last year.

According to Refinitiv data, lending in EMEA slumped to US$144bn in the first three months of 2020, the lowest figure for any quarter in a decade. Volumes did pick up slightly after that, as corporates tapped the debt markets for funds to help them weather the storm. However, last year’s figures were a relatively muted US$873.7bn, down from US$985bn the year before.

The data currently available for 2021 paints a similar picture. By the middle of the year, syndicated lending stood at US$419.8bn in Europe – down 17% on last year, which was the lowest opening period for syndicated loans in Europe since 2016. Loans in Africa and the Middle East totaled US$58.7bn, up 48% on 2020; however, this is far from

a dramatic recovery story overall.