The Nigerian financial sector is mired in liquidity shortages, the economy continues its slow progress out of recession, the Central Bank is in a major dispute with mobile operator MTN, and some international banks have packed their bags.

17 April 2024

The Nigerian financial sector is mired in liquidity shortages, the economy continues its slow progress out of recession, the Central Bank is in a major dispute with mobile operator MTN, and some international banks have packed their bags.

Egypt’s central banker, Tarek Amer explains value of trust

Strong trade winds are blowing throughout Sub Saharan Africa. Pushing companies forward are rising oil and commodity prices, but throwing the continent’s businesses off course is a deterioration of trust after a spate of defaults and the end of cheap credit globally.

Egypt stands at a crossroads both physically, situated between the Middle East and Africa and with the European market right next door, and with respect to its economic outlook.

EMEA Finance interview the renowned economist; Jeffrey Sachs.

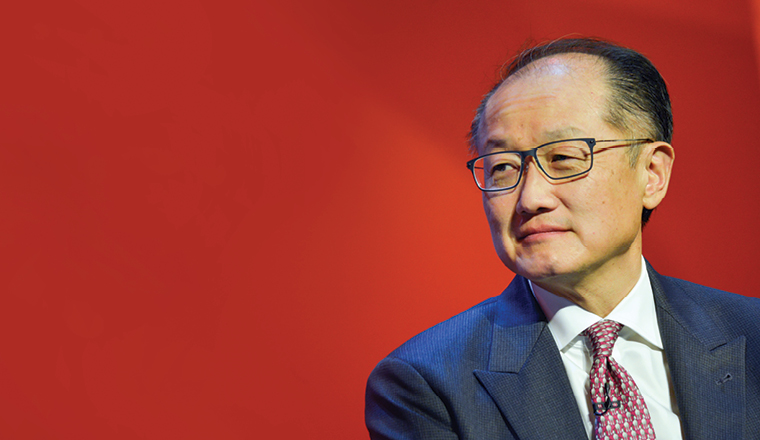

World Bank president Jim Yong Kim sets out a radical agenda for his second term that will move it away from direct funding towards de-risking projects in Africa to make them more attractive to private capital.

A new economic plan for Sub-Saharan Africa’s largest economy may hinge on whether the government is willing to bite the bullet on currency liberalisation.

Nigeria made a barn-storming return to the US dollar bond market when it defied expectations and shaky fundamentals to print below 8% yield on a book that almost hit US$8bn.

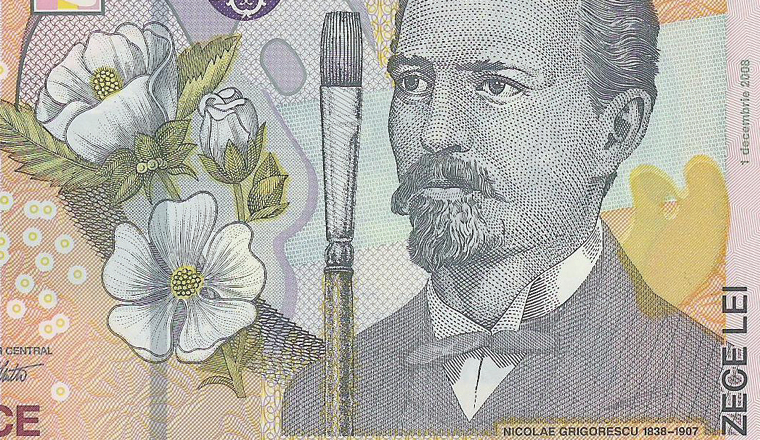

Romania placed its lowest yielding 10-year bond ever in early April, and the sovereign was rewarded for holding off from printing immediately after its mid-February budget.