Turkey has hit rock bottom.

26 April 2024

Off-grid power and captive energy projects are taking up some of the slack as big infrastructure deals stall, says Standard Bank.

Venture capital and private equity firm BlackFin Capital Partners has completed a more than €100mn first closing for a European business technology fund, with the fund’s founding partner telling EMEA Finance that the aim is to become a leading investor on the continent.

IBA has finally received investor approval to restructure US$3.3bn of debt after months of wrangling.

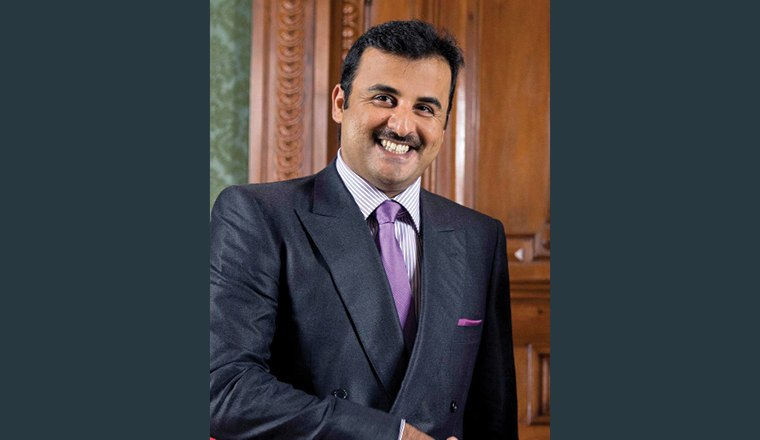

The Gulf was plunged into crisis in early June after Qatar came under a wave of sanctions led by Saudi Arabia that has already led to heavy selling in Qatari assets, as the crisis enters its fourth month, market analysts are trying to decipher when events may normalize.

African sovereign issuance is way down from its peak, but recent eurobonds have been oversubscribed as investors search for yield.

Russia’s PIK Group has plans to ramp up capital markets activity in the coming years, as the firm announces a consolidation of its shareholder structure with company president Sergei Gordeev buying out two minority holders.

UniCredit has sold €17.7bn of bad loans to US investment funds Fortress and Pimco, as Italian banks continue their balance sheet clean-up efforts following the country’s profound recession.

After 12 days of intense debate world leaders succeeded in agreeing a new accord to tackle climate change.