Embedded finance is tipped to become huge in consumer finance by providing customers with a way of paying for goods and services with minimal fuss, but this potentially highly disruptive technology is in its early stages, with many hurdles ahead.

27 April 2024

Embedded finance is tipped to become huge in consumer finance by providing customers with a way of paying for goods and services with minimal fuss, but this potentially highly disruptive technology is in its early stages, with many hurdles ahead.

Okechukwu (“Okey”) Enelamah is the chairman and founder of African Capital Alliance, a private equity firm founded in 1997. After more than 30 years in the industry, including a term in government, he is looking forward to the next chapter of Africa’s transformation.

Coverage of this year's winners and interviews with the teams.

Open banking is growing fast, with user numbers on the rise and a wealth of new use cases emerging. But how far does open banking have to go before it truly hits the mainstream?

With MiFID II and MiFIR now coming under review Europe’s trading landscape could become more efficient and transparent. Having gone live at the beginning of the year the Settlement Discipline Regime that provides a set of common requirements for central security depositories in the EU should reduce the number of failed trades and attract more investors.

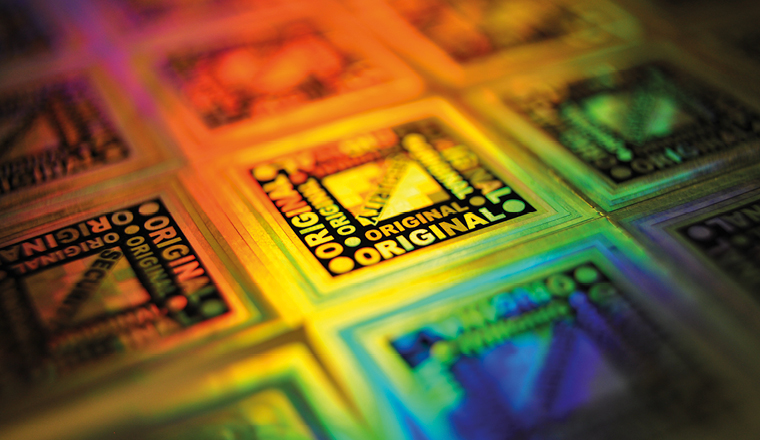

It has been twenty years since the first series of euro notes became a reality for 300 million Europeans. To mark the occasion, Dr Paul Dunn, chair of the International Hologram Manufacturers Association (IHMA), considers the anti-counterfeiting role holography has played and welcomes plans for the banknote’s first redesign.

Businesses in Sub-Saharan Africa are facing a tough few years, but the nimble and entrepreneurial continent is already showing signs of adapting with more spending on infrastructure and a major adoption of digitisation predicted by some of the region’s top bankers.

The Islamic Development Bank became the first ever issuer to place a public Sukuk using the Secured Overnight Financing Rate mid-swaps as the benchmark. This was accomplished even though Sharia-compliant, Sofr-structured Sukuk are backwards looking versus Libor’s estimated future borrowing costs pricing.

According to a report by Standard Chartered, emerging markets like the UAE will require significant private investment if they are to achieve a just transition.

Nigerian commodity exchange Afex has launched a US$100mn fund to improve food security across Africa, with smallholder farmers and warehousing infrastructure firmly in the fund’s sights for financing.

The contract lifecycle management company, which spun off from Deloitte in October 2020, has raised millions, attracted several of its clients as strategic investors, and has set its sights on rapid growth in the EMEA region.