For the third year, emeafinance is proud to announce the winners of our Middle East Banking Awards. The ceremony recognises the best performers in a competitive and dynamic market.

29 April 2024

For the third year, emeafinance is proud to announce the winners of our Middle East Banking Awards. The ceremony recognises the best performers in a competitive and dynamic market.

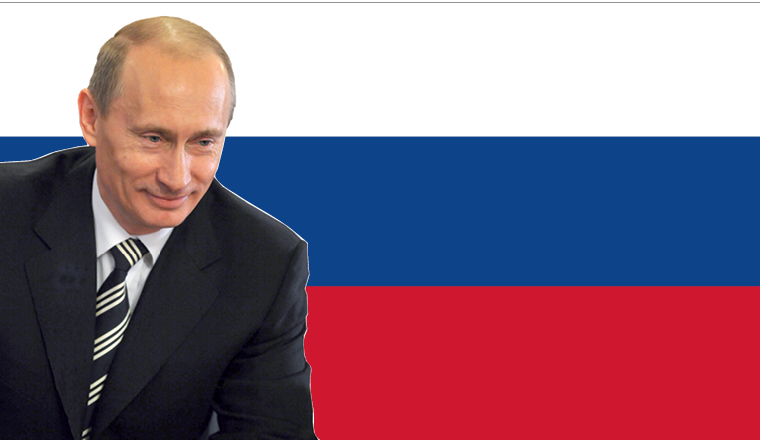

Eastern European governments are gearing up for a major round of privatisations in 2011, with Russia leading the way. Julian Evans looks at the businesses on the block.

The downturn proved how vulnerable the Tadawul’s reliance on Saudi investors has made it – attracting foreign traders could be the answer to its problems, but are they interested? Mark Dunne reports.

Can a business focused on sustainability make a superior return for its shareholders? Yes, and one investment firm has proved it. Tim Burke reports.

Egypt’s exchange is set for a shift as it strives to draw new listings and investors. Liz Salecka reports.

Iraq needs funds to rebuild and frontier investors are looking for high-risk, high-return opportunities. They seem an ideal match, so why isn’t there more liquidity in the market? Mark Dunne reports.

Following the EBRD’s vital support of Southeastern Europe‘s banking sector, its lead economist Peter Sanfey tells Tim Burke about the lessons the region should learn from the crisis – and what it needs to do next.

Last year the GCC lagged behind global emerging markets. Now, the region is in the spotlight after outperforming the MSCI emerging market index and attracting growing amounts of foreign capital. Julian Evans reports.

Richard Worthington built Coffeeheaven into a thriving coffee shop chain in Eastern Europe – and attracted the attention of an industry leader. He told Tim Burke about his journey.

Plans to create a single African economy within the next two decades are ambitious but achievable. Banks and stock exchanges are already primed for the benefits. Liz Salecka reports.

Despite the disappointing outcome of the Copenhagen climate summit, banks are still hopeful of a brighter future for carbon trading. If uncertainty around the clean development mechanism scheme is addressed, the African market for one could yet take off, reports Julian Evans.