Published: April 11, 2014

Republic raises US$1bn in 4x oversubscribed international issuance.

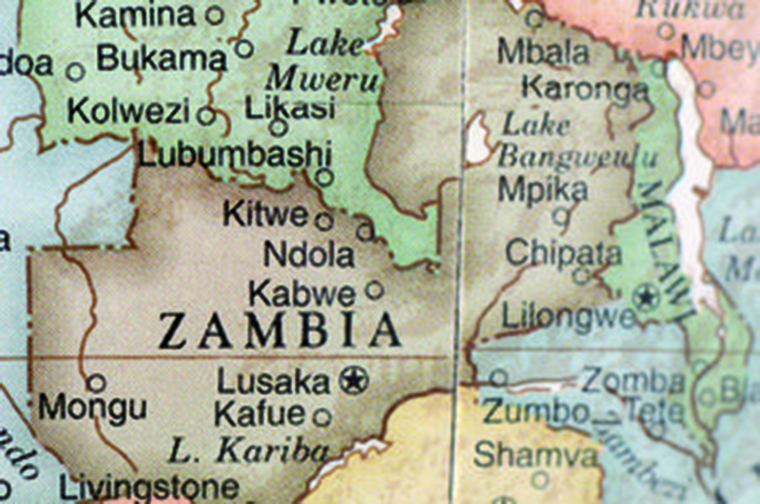

Zambia has issued its second sovereign eurobond, raising US$1bn from international investors. The proceeds will be used to back projects in the transport and energy sectors.

In a statement on the Ministry of Finance’s website, acting minister of finance Edgar Lungu said the government had spent two weeks working “exceedingly hard to rally international investors” behind the transaction.

Lungu gave no details of subscription levels or pricing, but a banker working on the deal has confirmed to EMEA Finance that the orderbook amounted to US$4.3bn and the bond was sold with a coupon of 8.5%.

The republic entered the international debt markets in September 2012, when its 10-year, US$750mn bond attracted an order book of some US$12bn. Barclays and Deutsche Bank ran that deal and the latest issuance.