Following Brexit, the UK may need to sever ties with the European Investment Bank (EIB). But what will that mean for businesses that currently receive essential EIB financing?

22 October 2024

Following Brexit, the UK may need to sever ties with the European Investment Bank (EIB). But what will that mean for businesses that currently receive essential EIB financing?

EMEA Finance interview the renowned economist; Jeffrey Sachs.

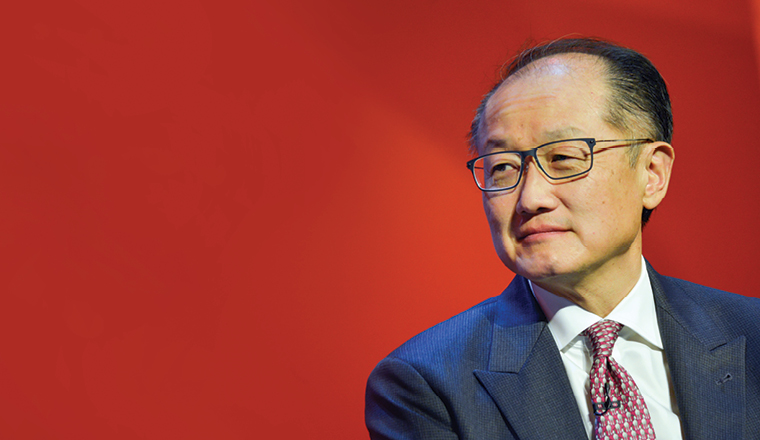

World Bank president Jim Yong Kim sets out a radical agenda for his second term that will move it away from direct funding towards de-risking projects in Africa to make them more attractive to private capital.

Nigeria made a barn-storming return to the US dollar bond market when it defied expectations and shaky fundamentals to print below 8% yield on a book that almost hit US$8bn.

Investors appear willing to back Egypt’s long-term growth, after the IMF delivered a US$12bn endorsement

Bank of Sharjah is marketing a new US dollar bond, and the issuer will likely have to field tricky questions on one of its major shareholders after Standard & Poor’s slashed the Emirate of Sharjah’s rating by two notches at the end of January.

The rapid rise in hard currency public sector debt in emerging market countries is combining with the weakening of EM currencies to create substantial economic and credit rating risks, Fitch has warned.

Angola’s balance of payments crisis has worsened, even as the oil price begins to rebound, and the government has turned to the International Monetary Fund to help shore up its stricken public finances.

The revelation that Mozambique had not disclosed US$1bn of debt underscores the governance challenges in Sub-Saharan Africa that are undermining investor confidence amid a commodity and currency rout.

Bank points to "well-diversified funding structure" and expected uptick in line with new strategy.